CRUZBER, one of the leading manufacturers of roof racks, roof bars, and transport accessories in the European market, presents its 2025 results, the most outstanding in its six decades of business. The €16.3 million in revenue reflects significant growth compared to previous years, the result of consistent effort and planned investment strategies. This is a very positive figure both domestically and in terms of exports, where 2025 has been characterised by sustained growth and recovery in the face of major challenges in the various markets where CRUZBER operates: high raw material costs, geopolitical tensions, and tariff threats.

With over 500 distributors for its two product brands – CRUZ and FIRRAK – CRUZBER offers a complete range of transport solutions for passenger cars, SUVs, and light commercial vehicles, with a clear commitment to international growth. The company currently operates in 43 markets across five continents.

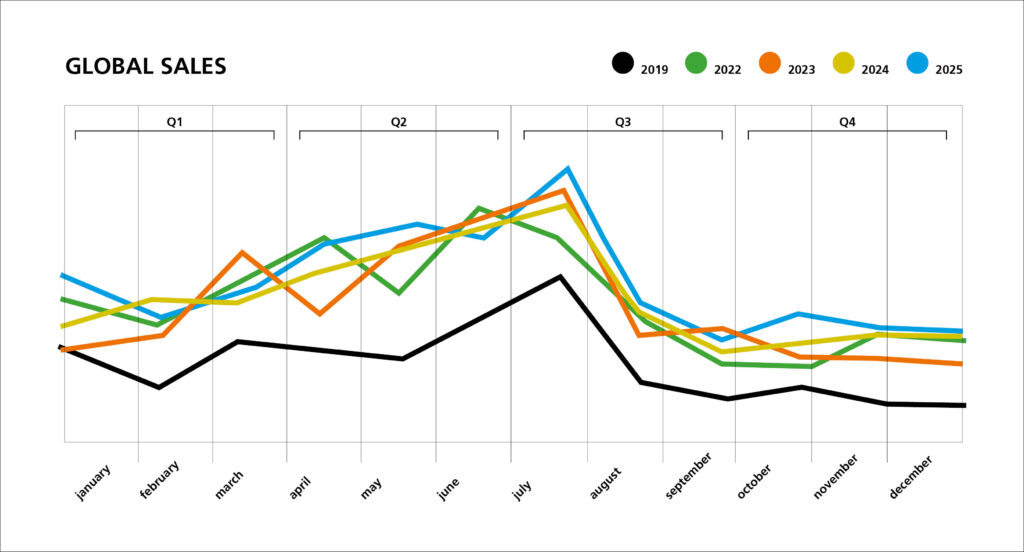

In 2025, sales showed a more balanced pattern, with periods of peak activity lasting longer, despite the inherent seasonality of the company’s products. While record sales figures were already registered in 2024, in 2025 CRUZBER broke its turnover record again, reaching €16.3 million, an increase of over 8.5% compared to the previous year. These are very positive figures for the organisation, reflecting CRUZBER’s strength and good performance in recent years.

The first half of 2025 (H1) accounted for more than 52% of total sales for the year. This represents a 5% increase in sales compared to the same period of the previous year. The second half of the year (H2) saw even greater growth compared to 2024. This period accounted for 48% of sales and an increase of more than 8.5% compared to the second half of the previous year. Overall, the year was characterised by less seasonality in product sales, with more sustained periods of high demand and higher sales levels.

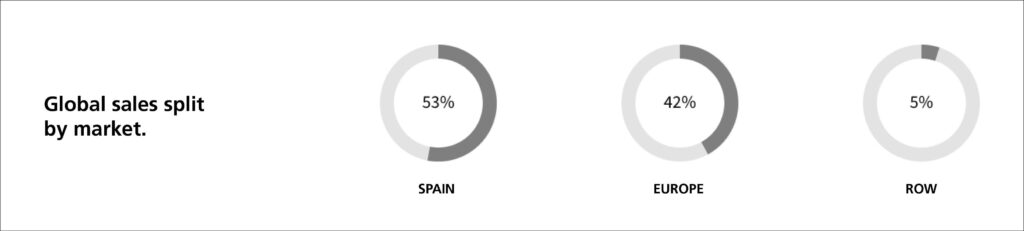

The slowdown in external growth, driven by a sluggish intra-EU economy, geopolitical tensions, and tariff measures in countries like the US, has strengthened Spain’s position as a primary market for CRUZBER. Domestic sales experienced significant growth and now account for 53% of the organisation’s global sales, positioning Spain as the main driver of stability and providing a foundation for the organisation’s international expansion. Europe represents 42% of sales, while other markets account for 5%. Having stabilised its post-Brexit situation, the UK has reclaimed its position as the top international market, followed by markets such as France and Poland.

Increasing the market penetration rate remains one of the organisation’s main objectives, especially in key markets. In this regard, Europe continues to be the backbone of CRUZBER’s international growth, along with Australia and New Zealand, markets for which specific products are being developed and will soon be launched globally. North America and Latin America maintain their future growth potential for CRUZBER.

The parent product category, LCV (light commercial vehicle), continues to outperform PC (passenger car) sales for another year. In fact, light commercial vehicles represent 56% of CRUZBER’s total revenue. This parent product category has experienced 10% growth compared to 2024. This data is related to the increase in vehicle registrations for companies and the self-employed, as well as CRUZBER’s greater development of the parent LCV category in the international market. Meanwhile, the PC category represents the remaining 44% of CRUZBER’s sales, also experiencing growth compared to the previous year, at just over 6%, exceeding the industry average.

rage.

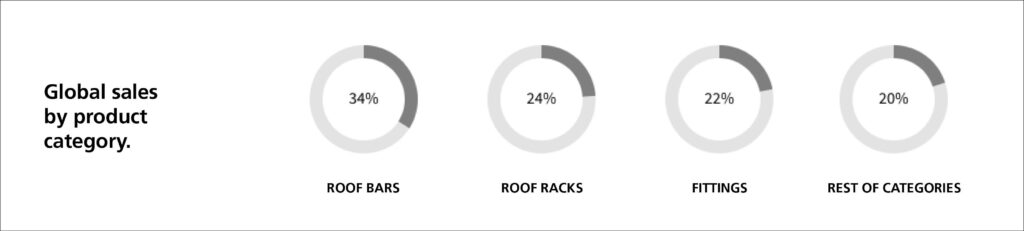

Product categories maintain similar weight in 2025 to previous years. Roof bars account for the largest share of sales, representing approximately 33% of the organisation’s revenue. Following this, roof racks (almost 24%) and fittings (21%) are the next most relevant categories, and then, with a greater difference, accessories, including bike carriers and roof boxes and travel cases. The roof box and travel case category is precisely the one registering the largest sales increase, with growth exceeding 15% compared to the previous year. In this context, CRUZBER reinforces its commitment to these product categories as the foundation for its future growth, presenting significant product launches within them, including: the new CRUZ Paddock elite 470 NT – limited edition roof box, which offers greater capacity and cargo space with a sporty design; and the new CRUZ Kicker AU – 2 bikes carrier for Australia and New Zealand, a robust hitch-mounted platform bike carrier with an anti-theft system, allowing for the transport of bicycles without any contact with the frame or fork.

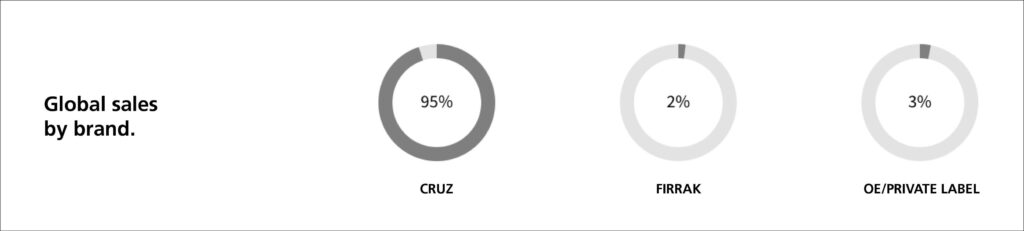

CRUZ maintains its position as the main product brand and contributes 95% of the organisation’s sales; it has a presence in 43 countries across five continents, in line with the organisation’s growth and positioning objectives. In 2025, the manufacture of products for original equipment manufacturers (OEMs) or third parties (private label) saw a slight increase, representing 3% of the total, despite not being a focus for the organisation. FIRRAK, CRUZBER’s second product brand, with a presence in 6 markets, contributes the remaining 2%.

In 2025, direct-to-consumer (DTC) sales for CRUZ (cruz-products.com) and FIRRAK (firrak.com) represented 2% of the company’s total revenue, establishing itself as a still-emerging business line with clear growth potential. Of particular note is the significant growth in DTC sales for the CRUZ brand, which increased by 37% compared to 2024. DTC sales objectives are being successfully met, allowing CRUZBER to be closer to the end consumer, strengthen brand awareness, expand and improve customer service, and obtain more agile and direct feedback for product and service improvements. That is why CRUZBER will continue with its initial plan to begin direct sales to the end consumer in other markets as well, in different phases planned for the coming years.

Marisa Cruz, financial director of CRUZBER, expressed her satisfaction with the results: “Fiscal year 2025 has marked a milestone for CRUZBER, consolidating our position as a leader in the sector and expanding our global presence. We have achieved record revenue of over €16 million, representing an 8.5% increase compared to the previous year. This reflects the constant effort of our team and the investment and development strategies implemented. These results have been supported by the performance of strategic segments and represent the first fruits of the investments made in recent years. Thanks to this, we have improved the efficiency of our processes and the quality of our products, and reinforced our commitment to sustainability and reducing environmental impact. The 2025 results not only reflect the strength of our operations but also reinforce our commitment to innovation in new product development, quality service, and supply chain efficiency to continue driving CRUZBER’s growth in the coming years.”

The company, which has around 140 employees, values collaborative work and the service excellence approach of each individual as key to the results achieved in 2025. Customer focus, professional development, and a shared commitment to sustainability and results are the pillars upon which CRUZBER’s strategies are based and with which it works to continue growing and consolidating its market position.

As in previous years, CRUZBER continued working throughout 2025 to improve its global supply chain to ensure greater flexibility and adaptability in the face of anticipated growth. The organisation continued implementing the various initiatives begun in 2023 and made significant investments in innovation, processes, equipment, and infrastructure to guarantee continued, sustainable, and environmentally responsible success and growth. During 2025, CRUZBER completed the implementation of new laser tube cutting equipment, which not only improves the production process by reducing lead times and generating energy savings in manufacturing, but also eliminates processes previously outsourced, resulting in improved product quality control. CRUZBER also made progress on the layout of its new building (over 2,500 square meters) for storing semi-finished products and assembling and packaging bicycle racks and other accessories. And it has worked on the new layout of an existing building (over 1,700 square meters) to modify its use and production processes, enabling the final assembly and storage of roof boxes and travel cases. This improves product quality control and provides greater flexibility to enhance and streamline service and product availability in this category. All of this demonstrates the organisation’s clear focus on innovation, continuous improvement, and sustainability as the foundation for future growth.

Guillermo Ballesteros, assistant managing director of CRUZBER, expressed his enthusiasm for the organisation’s future: “Our focus is on getting closer to the customer, strengthening our CRUZ and FIRRAK brands, and boosting our distribution channels, with more than 500 distributors in 43 markets. The combination of user experience, product development, and market expansion will allow us to maintain balanced and sustained growth. Reaching more than €16 million has been possible thanks to the teamwork and entrepreneurial spirit that characterise CRUZBER, as well as the constant pursuit of excellence in service and customer care. CRUZBER is steadily progressing toward its strategic objectives, consolidating its position as a leader in the sector and paving the way for the coming years of global expansion.”

CRUZBER is steadily progressing towards its ambitious long-term strategic goals, which can be summarised as follows: achieving global revenue exceeding €25 million; ensuring that exports account for over 60% of the organisation’s total revenue; consolidating a significant presence in more than 60 markets across five continents; maintaining a profitability of around 20% (EBITDA); and reducing its total emissions by 90%. To achieve these ambitious goals, the company is maintaining its roadmap focused on user experience and sustainability, supported by three fundamental pillars: growth through product development, efficiency throughout the supply chain, and the expansion of markets and channels.